“Massive meltdown”: 40% of Nasdaq companies are down more than half from their highs

01/09/2022 / By News Editors

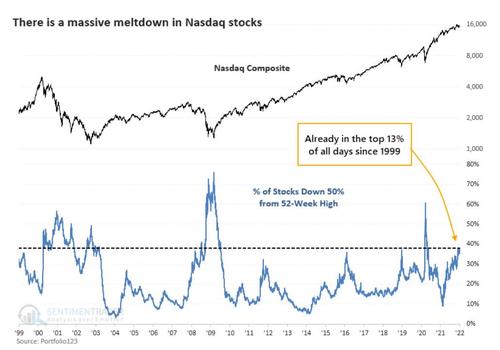

In a testament to the narrow breadth of the Nasdaq, and the broader market in general, where as a reminder 51% of all market gains from April through December were just from the five most popular tech names – AAPL, MSFT, NVDA, TSLA, GOOGL – Sundial Research notes that a near-record number of tech stocks have plunged by some 50%, a number that was only surpassed by the March 2021 crash and the global financial crisis.

(Article by Tyler Durden republished from ZeroHedge.com)

Roughly four in every 10 companies on the Nasdaq Composite have seen their market values cut by 50% or more from their 52-week highs, while a vast majority of index constituents are mired in bear markets, according to Jason Goepfert, chief research officer at Sundial.

“Whatever the fundamental and macro considerations, there is no doubt that investors have been selling first and trying to figure out the rest later,” Goepfert said in a note and first noted by Bloomberg.

It’s also why hedge fund holding all but the largest companies have had a miserable year, and why as we noted earlier, hedge funds had already undergone some of the biggest selling and degrossing in the past decade ahead of yesterday’s FOMC minutes rout.

“Valuations are at historical highs, companies are raising billions based on fairy dust, and the Fed is signaling a tightening cycle,” Goepfert said. “All of these are scaring investors that we’re on the cusp of a repeat of 1999-2000.”

Tech stocks have been under especially heavy selling pressure since the start of the year amid a bond-market rout that’s sent 10Y TSY surging as high as 1.75% on Thursday, surpassing the highest level of 2021. The carnage accelerated after the latest FOMC minutes pointed to earlier and faster rate hikes, suggesting to some that the central bank became more hawkish quicker than many had expected. As a result, traders were quick to dump high-duration tech shares, whose high valuations become harder to justify in a rising-rate environment.

The Nasdaq index is on pace for its biggest weekly decline since November, even as it rose in the New York afternoon trading session Thursday. A 3.3% fall Wednesday marked its worst single-day session since February last year. However, the drop has been relatively contained thanks to the continued support of the big five generals, which have so far been resistant to wholesale selling.

Read more at: ZeroHedge.com

Tagged Under: Big Tech, collapse, corporations, crisis, economics, finance, NASDAQ, risk, stock market, stocks, tech giants

RECENT NEWS & ARTICLES

COPYRIGHT © 2017 BigTech.news

All content posted on this site is protected under Free Speech. BigTech.news is not responsible for content written by contributing authors. The information on this site is provided for educational and entertainment purposes only. It is not intended as a substitute for professional advice of any kind. BigTech.news assumes no responsibility for the use or misuse of this material. All trademarks, registered trademarks and service marks mentioned on this site are the property of their respective owners.